This article of mine is also published in ICAI's December 2013 journal.

http://220.227.161.86/31534cajournal_dec2013-14.pdf

Executive

Summary:

As we look

forward for implementation of Converged IFRS standards, let us touch upon a

topic of disclosure in financial statements. With the need of transparency by

Indian Companies and increasing vigilance on domestic transfer pricing

transaction, the Related Party Disclosures standard would gain much prominence.

This Article brings out a quick impact

of the new standard with dependencies in Companies Act, 1956 and various

thought points that need to be addressed for effective implementation of Ind AS

24, in comparison to AS 18 read with its various interpretations and IAS 24, followed by an illustration to

summarise the impact.

Introduction

Ind AS 24 is notified by Ministry of Corporate Affairs (MCA) along

with other Ind ASs on February 25, 2011, however its implementation date is yet

to be notified. Ind AS 24 governs the disclosure of related party

relationships, transactions and outstanding balances, including commitments, in

the consolidated and separate financial statements of a parent, venturer or

investor presented in accordance with Indian Accounting Standard (Ind AS) 27- Consolidated and Separate Financial

Statements. This Standard also applies to individual financial statements.

Ind AS 24 - Related Party Disclosures is the only standard that looks up the definition of “Relatives” under the Companies Act for

defining “close members” under the

standard. The Companies Bill 2012 is successfully approved by the lower house

of the parliament i.e. Lok Sabha and is now tabled in upper house, which

includes revised definition of “Relatives”

under the Act. We now have a complete framework for assessing the implications

of Ind AS 24 i.e. Related Party

Disclosures when it is gets notified date for practical application in

India.

Ind AS 24 comes in with new relationships as well as additional

disclosures when compared with AS 18 read with ASI 13,19,21,23. At the same

time it is not the same as International Accounting Standard (IAS) 24. Let us

appreciate the nuances of this new standard in light of the principally approved regulatory framework.

Critical changes

as compared to AS 18 – Related Party

Any transaction’s counter party is either an individual or an entity

/ firm and hence the related parties standard also lays down the criteria to

capture various ways in which these individuals and entities are covered for

reporting, namely under para 9a and b of Ind AS 24 respectively. Let us

appreciate the changes in these two broad categories.

Coverage

in terms of Individuals

In terms of identifying persons i.e. individuals, as related

parties, Ind AS 24 brings in new requirements with respect to the following:

I. Key

managerial personnel (KMP)

II. Close members

of family

I. Key managerial personnel

The definition of KMP has been widened by including

all the directors on board, whether executive or otherwise. Additionally, it

includes KMP not only of the reporting entity but also of the parent entity.

This standard will override the Accounting

Standard Interpretation 21 i.e. ASI 21 to AS 18 which concludes that the requirements of AS 18 should not

be applied in respect of a nonexecutive director even if he participates in the

financial and/or operating policy decision of the enterprise, unless he falls

in any of the categories in paragraph 3 of AS 18. (refer para 9 b vii of Ind AS 24)

Thus the list of

persons in the capacity of KMPs of the reporting entity has increased and

consequently adding in the relatives of those identified people. For example, if

a non executive independent director is paid a consulting fee by a subsidiary,

the same will have to be reported by the subsidiary entity. To extend the

example, if the fees are paid to spouse of such director of the holding

company, the new standard requires such transaction to be part of related party

disclosures of subsidiary entity.

Note: ASI 23 clarified that remuneration paid to executive directors

on board is a transaction to be reported under AS 18. This position remains

unchanged under Ind AS 24.

II. Close members of family i.e. Relative

Ind AS 24 uses the

term Close members of family instead of Relatives of Individual under

existing AS 18. “Close members of the family of a person are the persons specified within meaning of

‘relative’ under the Companies Act 1956 and that person’s domestic partner,

children of that person’s domestic partner and dependants of that person’s

domestic partner”. (para 9)

AS

24 definition of Relative in relation to an individual includes the

spouse, son, daughter, brother, sister, father and mother, who may be expected

to influence, or be influenced by, that individual.

Companies Bill

2012 defines Relative to include

members of Hindu undivided family (HUF) and husband / wife or any other person

as may be prescribed.

Reading

these definitions, we understand that there is a potential addition to the list of individuals under this category

wherein members of HUF say brother’s wife i.e. Sister in law and their children

are included if they are part of the same HUF as that of the individual.

In

this case, the individual is a person having control, joint control or

significant influence over the reporting entity or is a KMP of the reporting

entity or its parent entity. So the coverage of related party list may

increase considerably.

In addition, there is a new requirement

to include a person’s domestic partner, his / her parents and children. Point to note is, there is no definition of

‘domestic partner ‘ in the Accounting Standard nor in the Companies Act 1956.

Coverage

in terms of entities

a. Entities / members of the Same

Group, which will include each parent, subsidiary and fellow subsidiary

companies. (para 9b i)

It would be fairly simple to test this criterion if it

is a holding structure with a clear corporate operating entity at the apex

level. However when it is held ultimately by a Trust, the application becomes

little difficult. Similarly, it is possible that the ultimate holding company

is an Investment or a Private Equity fund. The Fund will consider the

investments as held for trading and will not consolidate them in its balance

sheet as per latest amendments in International Financial Reporting Standard

(IFRS) 10 which governs consolidation requirements.

For example, a private equity fund may acquire more

than 50% stake in a startup entity and it may also hold similar interests in

other entities. In this case, whether the start up entity will consider other

investments of its Private Equity Investor as fellow subsidiaries is a question

to be addressed based on its substance. Again, if the ultimate holding of an

entity is a Discretionary Trust whose beneficiaries include Promoter group

members along with Charitable Institutions, it will be again a matter of

assessment whether such Trust should be considered as an ultimate controlling

body and consequentially whether the group definition will include all the

entities controlled or significantly influenced by such trust or restrict only to the subsidiaries

and associates of the last holding entity that is not a discretionary trust or

private equity fund. A lot of judgment

will have to be applied in considering the entities within the same Group in

these scenarios. Companies will have to look up to Ind AS 27 and Ind AS 110

for assessment of control via substantive or protective rights in areas of significant

judgment.

It is to note that ASI 19 provides interpretation for the term “intermediaries” in the

context of ‘control’ and ‘significant influence’. It clarified that the

intermediaries mean subsidiaries of the group and should not be extended to

include associates. However, this term of intermediaries is not present in Ind

AS 24, but the substantive view may continue to prevail in assessing the

relationship in a wider group. For example, subsidiary of entity’s associate may

not be a related party but associate of a subsidiary will be one. There may be a view that in the former case,

the subsidiary of associate could be argued as an entity on which the reporting

entity can exercise significant influence, however it becomes challenging is

the associate has a number of subsidiaries. Thus considering Subsidiaries of

associate may be farfetched for consideration of disclosure under the standard.

b. An

associate or joint venture of any member of the same group in which the

reporting entity is consolidated as a subsidiary. In comparison to AS 18,

the relationship point has now been enlarged to cover not only the reporting

entity but all group entities. Again, the assessment of the group will have

to be done as stated in point b above. (para 9 b ii)

In the

definition of a related party, it is pertinent to note that an associate

includes subsidiaries of the associate and a joint venture includes

subsidiaries of the joint venture. Therefore, for example, an associate’s

subsidiary and the investor that has significant influence over the associate

are related to each other and thus the coverage of “same group” gets wider.

(para 12)

c. Under Ind AS 24 there is extended coverage in case of joint

ventures. Two entities are related to each other in both their financial

statements, if they are either co-venturers or one is a venturer and the other

is an associate (para 9 b iii & iv). Whereas as per existing AS 18,

co-venturers are not related to each other. However as a breather, one may

note that two associates with a common investor are not considered to be

related parties for their respective standalone entity disclosures under Ind AS

24.

d. Post employment benefit trusts are now newly covered under Ind

AS 24 (para 9b v).

e. Entities controlled, jointly controlled or significantly

influenced by individuals covered in the above section. Significant influence

is also by being a KMP of that entity or the parent of that entity (para 9b vi).

There requirement is similar to that under existing AS 18.

Disclosure

aspects

i. Name of the related disclosure under Ind AS 24 is to be done

only for entities where control exists. Name disclosure for all other related

party transactions is not part of the minimum disclosure requirement as laid

down in para 18 of Ind AS 24.

ii. Ind AS 24 requires an additional disclosure with respect to the

name of its parent and if different, the ultimate controlling party. If neither

of them produces consolidated financial statements for public use, then the

name of the next most senior parent is to be disclosed, whereas the existing AS

18 has no such requirement. (para 13)

iii. ASI 13 requires that for the

purpose of applying the test of materiality as per paragraph 27 of AS 18 for non

aggregate disclosure, ordinarily a related party transaction, the amount of

which is in excess of 10% of the total related party transactions of the same

type (such as purchase of goods), is considered material, unless on the basis

of facts and circumstances of the case it can be concluded that even a

transaction of less than 10% is material. It is to note that the same para 27 is incorporated

as para 24A in Ind AS 24. Since the

ASIs will be no longer part of the Ind AS framework, one may look forward for

its substantive application in practice.

Comparison with IAS 24, Related Party Disclosures

In terms of practical

application, there are two potential differences that can make the disclosure

under IFRS and Ind AS. They are as follows:

a) Considering

the definition of Close family members from the Companies Act 1956, which is

different from IFRS.

b) Substantive

application of para 24A which is brought in from existing AS 18.

Thought Points

1. Inclusion of HUF members as close family members

for reporting.

2. No definition of a Domestic partner. Dependents

of domestic partner included.

3. Dependents of wife are not included unless part

of HUF.

4. Father and Mother are not default related

parties, unless dependent or part of HUF.

5. Non executive director will be considered as a

KMP.

6. Maintain a comprehensive list of relatives for

individuals having control, significant influence or KMPs, including KMPs of

the holding company.

7. Application of significant judgement in

considering the “same group” in certain holding structures.

8. Subsidiaries of associates and joint ventures

are also related parties and are to be disclosed in the category of associates

/ joint ventures as the case may be.

9. Increased the coverage of individuals as well as

entities.

10.

For disclosure, considering the same para 27 of

AS 18 being included as para 24A under Ind AS 24 on aggregate disclosures, the

substantive application of ASI 13 would be something to look forward.

11. Minimum disclosure requirements exclude name of

related parties with whom transactions are made, except for those entities

wherein control exist irrespective of transactions during the period.

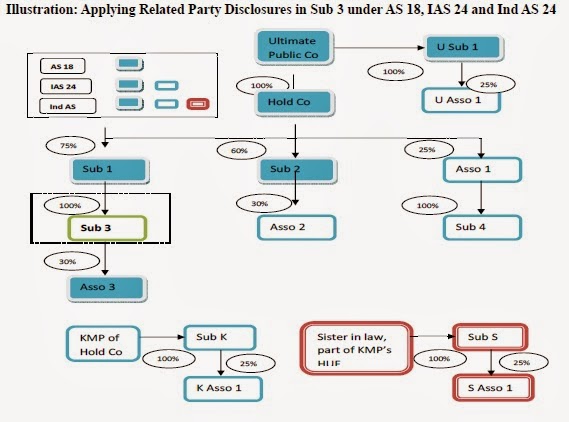

Analysis:

1. Under

AS 18, associates of the reporting entity are only considered, whereas under

Ind AS 24, associates of the Group are considered as related parties.

2. Subsidiary

of associate (Sub4) is also a related party as read with paragraph 12 of Ind AS

24.

3. MPs

of the holding Company along with entities in which they and their close family

members are related to Sub 3 under Ind AS 24.

4. Under

Ind AS 24, as the definition of close family members looks up into Companies

Act, 1956, members of HUF also become related and hence entities controlled and

influenced are part of disclosures.

No comments:

Post a Comment